If you are a startup founder, you will no doubt have heard how important a ‘’Cap Table’ is for not only tracking your company’s ownership, but also as an important tool for providing potential investors a snapshot of this crucial information.

In this simple guide, you’ll learn key Cap Table basics, including:

What is a Cap Table?

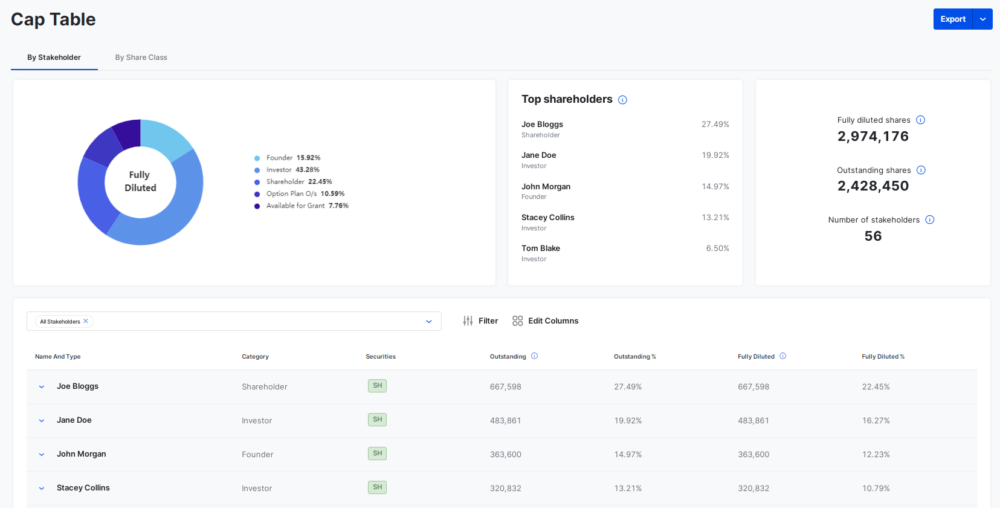

A Cap Table, or Capitalization Table, is a document that visually represents equity ownership in a company. It should include details of who has ownership in your company, and how much they each own. It should also list all of your company’s securities, e.g. stock, stock options, convertible notes, warrants, etc.

For startups, a Cap Table is an extremely important document for helping both founders and investors make informed decisions regarding the company. So, in the early stages of a startup or venture, Cap Tables are normally created first, before other company documents.

Cap Table breakdown

While there is no fixed format for how a Cap Table should be structured, usually one will show the following details:

- A complete list of shareholders

- Ownership details for each shareholder (founders, investors, stockholders, etc.):

a/ Type of Equity

b/ Total ownership (i.e. how many of each equity type they own)

c/ Ownership percentage (i.e. what percentage they own) - Unissued shares (i.e. allocated but has not yet been issued)

- Outstanding shares (i.e. shares issued and actively held by shareholders)

- Stock option pool (i.e. a collection of stocks reserved for employees)

Why do you need a Cap Table?

An accurate, updated and clean Cap Table is an important tool for helping startups to make informed financial and hiring decisions.

It can be used in many different ways:

- Understand who owns what:

As a Cap Table outlines equity ownership in your company, it gives a clear idea of who owns what. Founders and co-founders can avoid conflicts later about how much equity is allocated to each of them. - Track the value over time:

A well-managed Cap Table allows you and your investors to understand the value of a startup over time, so you can stay on top of the financial status of your business. - Raise funds or attract investors:

Investors will often look for details about company ownership and changes since previous funding rounds. If you have a well-maintained Cap Table in place, investors can have confidence when you show them who owns what part of a company. They may use this information to predict future dilution and analyze if the employee option pool is sizable for recruitment, which may help with their decision making. - Recruit employees:

Employee stock options are a common equity compensation form to help companies attract talent as they could generate substantial financial returns. As a Cap Table shows the number of options available to issue, you can quickly determine how much more you can offer to a potential employee.

Therefore, it is essential that your Cap Table needs to always stay up-to-date, showing all of the ownership information, how many shares each owns, and detailing how ownership becomes diluted as your company grows.

How do you create a Cap Table?

You can generally create a Cap Table by using a spreadsheet template or Cap table management software.

Spreadsheet

When a company is young, and at its most basic, a Cap Table is often an Excel spreadsheet, which is fine to start with. After a few rounds of financing, the Cap Table will become more complex and therefore prone to human error. So, spreadsheets won’t scale with you as you grow.

Cap Table management software

Companies will often shift to using Cap Table management software when they become aware of the issues associated with using spreadsheets. Software has the advantage of updating accordingly for you as ownership or financial changes happen, removing the time-consuming and error-prone manual update element.

Software like Global Shares’ Cap Table can also help you stay compliant regarding audit checks.

When do you need to update your Cap Table?

After creating one, you’ll need to maintain it regularly. That’s because you don’t just need a Cap Table – you need an accurate, reliable, and dynamic Cap Table.

There are certain events in your company’s life which will change the ownership structure and the fair market value (FMV). Some of the events include:

- At the time of each funding round

- At the time of each M&A

- Each issue of new shares

- Each transfer of shares to another shareholder

- Each buy back of shares

- After every 409A valuation

Who is responsible for running your Cap Table?

The majority of times, Cap Table management is done either internally with one of the founders or a CFO, or externally via the company’s lawyer.

If handled in-house, you can get complete control of the Cap Table design and structure and have access to it anytime you need to update it. However, as a startup founder or CFO, you will more than likely constantly have your hands full. Forgetting to update your Cap Table in a timely manner can create significant problems in the future. This is just one potential way that human error can slip in easily.

If you outsource your Cap Table management to your law firm, the obvious benefit is that you offload some of your work to a professional body. However, your Cap Table may not be readily available as you are not guaranteed to have instant access to it.

Contact Global Shares, a J.P.Morgan company, today.

We can work with you to simplify your Cap Table management by updating it accordingly as changes happen, whether they are new funding rounds, an introduction of employee equity plans, co-founders moving on, or a range of other events. Contact us.